Tax Notices

2025

Taxes were due December 31st, 2025. 2026 Taxes will be levied in July.

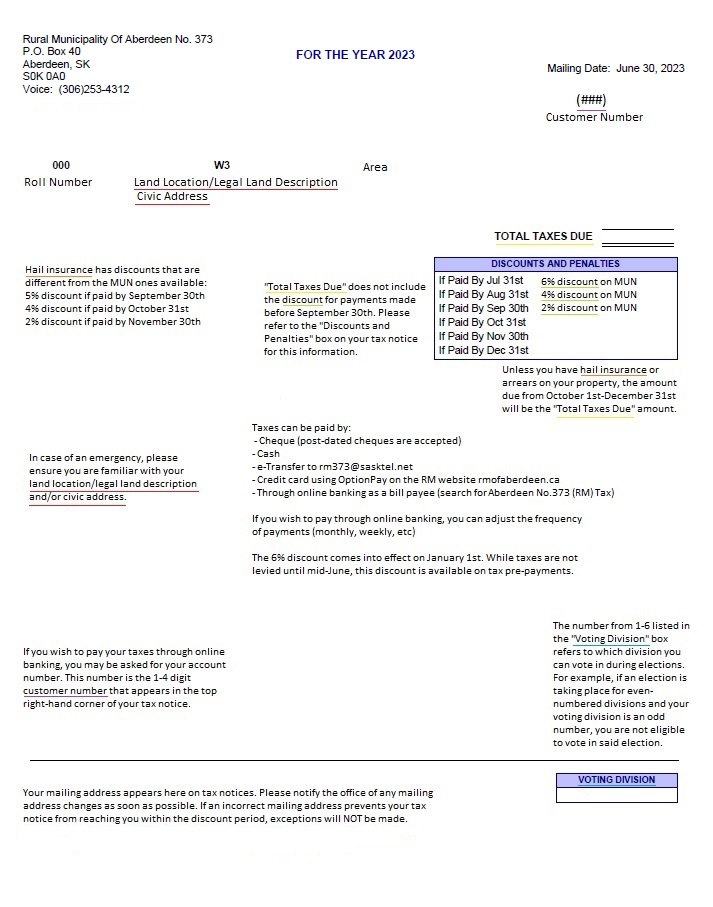

Discounts for the Municipal (MUN) portion of 2026 Taxes:

- 6% if paid by July 31st

- 4% if paid by August 31st

- 2% if paid by September 30th

*Note: There is no discount available on the school portion of taxes

(200-#206 [Public Support] or 203-SPSD [Separate Support])*

Out of office payment options:

- credit card using OptionPay [tiered rate table]

- e-Transfer to rm373@sasktel.net

- mailed-in cheque(s) [can be post-dated]

- by setting the RM up as a Bill Payee through online banking [banks and accounts] please consult the sample 2023 Tax Notice below to see where your customer/account number can be found.

In office payment options:

- cheque

- cash

Please note the RM Office does not have a debit machine. The only payment options available are those listed above, which also appear on your Tax Notice.

Taxes are levied and Tax Notices are sent out in July. If taxes are not paid by December 31st of the current year in which they're levied, they will be considered arrears and penalties (at a rate of 1% of the remaining balance per month) will be added to the tax roll January 1st of the following year. Please refer to the image below for more information on how to understand your Tax Notice.

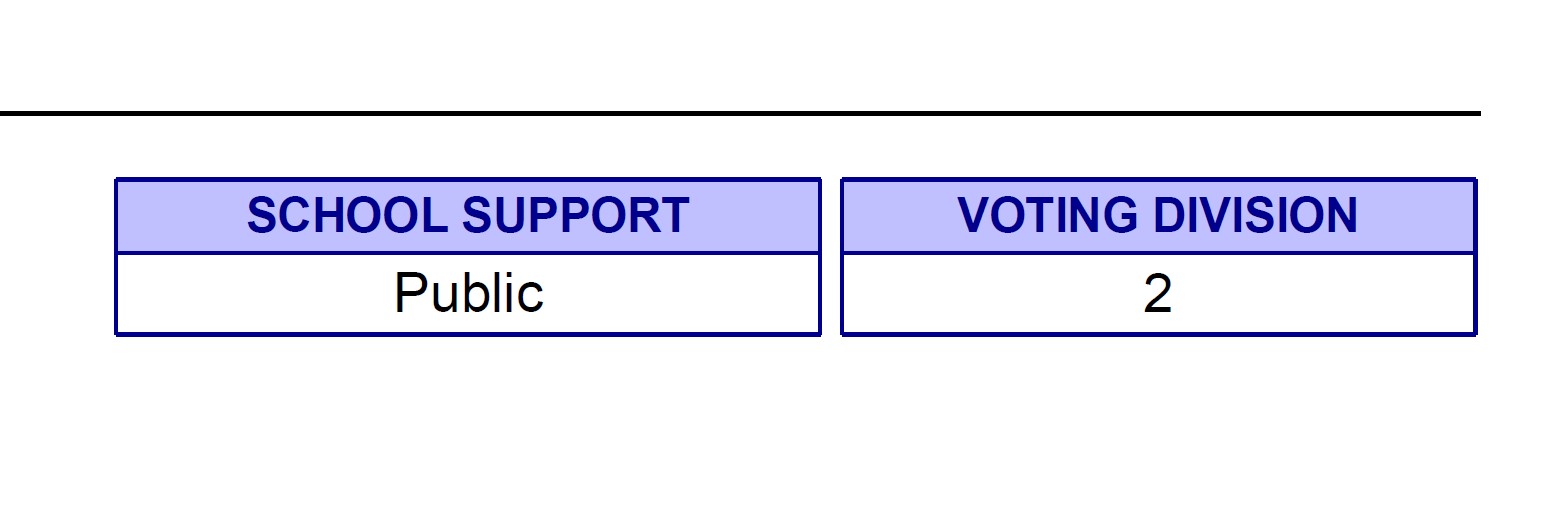

If you wish to change the school portion of your taxes from Public Support to Separate Support or vice versa, please fill out the School Tax Declaration Form and submit to the RM Office by February 28th of the year in which taxes are levied. Taxes are automatically paid to the Public School, unless changed through submission of the aforementioned form.

More information on Elections and Voting Divisions

.png)